TWO STEPS TO REDUCE THE NUMBER OF NEW JERSEY STUDENTS IN UNDERFUNDED SCHOOLS

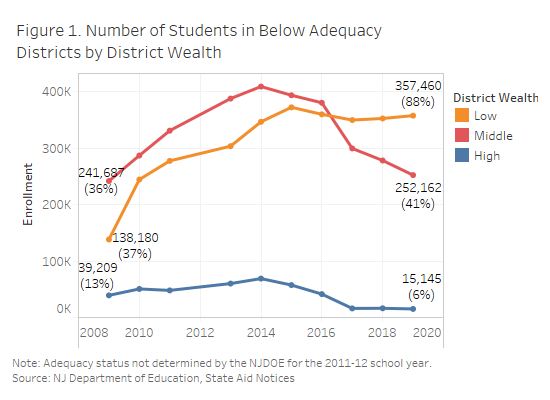

A new analysis by Education Law Center shows that, over the last decade, the percentage of students in districts funded below the required constitutional, or “adequacy,” level grew to over half of all students statewide. Low wealth communities bore the brunt of the increase, with 88% of students in those communities attending underfunded schools.

To begin to stem the tide, ELC recommends Governor Phil Murphy and state legislators take two immediate steps: 1) target any new state aid increases only to below adequacy districts, and 2) lift the property tax cap for below adequacy districts that are under their local fair share.

More Students in Below Adequacy Schools

The essential component of New Jersey’s School Funding Reform Act (SFRA) is the formula’s definition of the funding level required for every district to provide students with the staff, programs and resources necessary for a through and efficient education under the State Constitution. That funding level, called the “adequacy budget,” is determined based on the unique student enrollment of each district, including the number of low-income (“at-risk”) students, students with disabilities, and English language learners.

The impact of eight years of cuts and flat state aid under former Governor Chris Christie resulted in almost no progress in moving districts towards their adequate funding level under the SFRA. In 2008-09, when the SFRA was first implemented, 129 districts were spending below adequacy. By 2018-19, the number of below adequacy districts had grown to 146. Nearly half of all students in the state are currently attending schools that are spending below the SFRA’s definition of adequacy, up from 31%.

Students in low wealth communities fared the worst over the ten-year period (see Figure 1). In 2009, 37% of students in low wealth communities were in districts spending below adequacy, but that number grew to 88% in 2019. At the same time, few students in high wealth communities attended school in districts spending below adequacy; that share declined from 13% to 6% over the same period. The percentage of students in below adequacy districts in middle wealth communities grew from 36% to 63% in 2014. Recently, conditions have improved but are still worse than the first year of the SFRA.

There are two factors that determine whether a district is above or below adequacy: state aid and local property tax revenue. Some districts are below adequacy because of the state’s failure to fund its portion of the adequacy budget; others are below because local taxpayers are not supporting their share; and still others are not meeting either goal.

In order to ensure that all below adequacy districts begin making progress, New Jersey lawmakers can enact these two simple reforms:

Step 1: Target New State Aid to Below Adequacy Districts

The influx of new state education funding in the 2019 budget – a total of $383 million distributed to 391 districts – is a significant improvement over many years of flat funding or minimal increases. However, with the modifications to the distribution of state aid adopted in Senate Bill 2 (S2), those aid increases were not fully targeted to students most in need of additional funding.

Contrary to the original distribution method in the SFRA, which provided substantially larger increases to below adequacy districts, S2 does not distinguish between districts that are spending above or below adequacy. Instead, in 2018-19, each district received at least 58% of the state aid required to support its adequacy budget. In FY20 and beyond, there are no state aid targets at all. Instead, districts are slated to receive a “proportionate” share of the overall state aid increase.

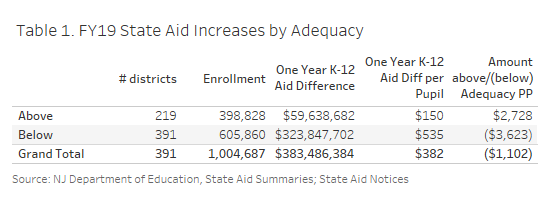

While below adequacy districts did receive the majority of the funding increase, 219 districts whose 2017-18 spending was already above their 2018-19 adequacy target received nearly $60 million in new state funding (see Table 1).

After a decade in which the school funding formula was essentially ignored, the state’s immediate priority should be to focus on bringing all districts to adequacy. Any state aid increases should be targeted to below adequacy districts. Above adequacy districts should receive state aid increases, which can be used for property tax relief, only after New Jersey has fulfilled its obligation to fund the state’s portion of SFRA funding in below adequacy districts.

Step 2: Lift the Property Tax Cap for Districts Below Their Local Fair Share

About half of the below adequacy districts need to raise additional local revenue to meet their adequacy target. Some districts are raising as little as 30% of the property taxes that the SFRA defines as their local fair share (LFS). The 2% property tax cap makes it impossible for the vast majority of these districts to reach their LFS because the capped amount is so far below what is required by the SFRA. For example, Commercial Township is below its LFS by over $1.2 million, but can only raise an additional $39,000 under the 2% cap. North Bergen is over $23 million below its LFS and can only raise about $1 million under the cap (see list of districts here). The 2% cap is illogical when applied to districts not meeting their LFS, and it deprives students of the resources owed them under the state’s own formula. Any below adequacy district taxing below their LFS should be exempt from the cap.

Easing the property tax cap can help some districts meet their local funding obligation, but only if the municipalities have the economic capacity to continue to raise taxes. More than half of the 93 districts that are currently raising less than 95% of their LFS have property tax rates that are already above the state average. Not surprisingly, most of these highly taxed districts are low wealth communities that are spending below adequacy. A thorough evaluation of the LFS calculation is required to ensure that the SFRA places reasonable expectations on districts to raise local revenue and accurately reflects their taxing capacity.

Going Forward: Keep Focus on Adequacy

In signing off on the SFRA in 2009, the New Jersey Supreme Court emphasized that districts’ adequacy budgets are at the heart of the formula, and full funding of those budgets is central to the SFRA’s continuing constitutionality. New Jersey’s tight fiscal constraints mean increases in state school aid are likely to grow at a modest pace over the next several state budget cycles. It is imperative, therefore, that aid increases are restricted to districts with funding below adequacy. It is also crucial that those districts with underfunding due to local revenue gaps be exempted from the 2% property tax cap. With these steps, the state can ensure students in underfunded schools remain the top priority.

Press Contact:

Sharon Krengel

Policy and Outreach Director

skrengel@edlawcenter.org

973-624-1815, x 24

Press Contact:

Sharon Krengel

Director of Policy, Strategic Partnerships and Communications

skrengel@edlawcenter.org

973-624-1815, x240