Over the past four years, Florida has seen tremendous growth in the amount of public funds being spent on private education. In this report we find that:

- In 2022-23, an estimated $1.3 billion in funding will be redirected from public school districts to private education, representing 10% of state K-12 education funds allocated through the Florida Education Finance Program (FEFP), the state’s school funding formula;

- This sum is in addition to a potential $1.1 billion dollars taken from general revenue that would otherwise be used to support state services, including education, as a result of tax credits claimed by businesses that donate to voucher programs;

- Deductions to local school districts’ budgets to account for students receiving vouchers occur after annual school budgets have been finalized. This poor timing is even more challenging because of mid-year increases in voucher costs and district fixed costs;

- The impact of vouchers on districts’ budgets ranges up to 9% of the total FEFP budget (state and local dollars) as of the start of the 2022-23 school year.

The movement of public funding to private education occurs in the context of Florida’s substantial underfunding of the state’s public schools, as highlighted in Making the Grade 2021. Florida receives an F on an A-F scale on all three funding metrics: funding level, funding distribution, and funding effort.

For detailed information on Florida private school voucher programs, click here.

Since 2019, the flow of public funds to private education dramatically increased after the State Legislature enacted the Family Empowerment Scholarship (FES) program. While voucher programs are often funded as line-item appropriations in the state budget or through state tax credits, the FES voucher is funded from FEFP state allocations that would otherwise be directed to the student’s resident public school district. In 2021, legislation expanded eligibility for the FES voucher program resulting in even more state tax dollars being re-routed from public school districts to private education throughout the state.

The data available for the past four years, shown in Figure 1, displays the increased transfer of public funds to private education.[1] Between 2019-20 and 2022-23, funding redirected to private education from the state FEFP formula increased by $1 billion, with the increase in diverted funds outpacing increases in public school funding. As the McKay Scholarship program for students with disabilities, also funded through the FEFP, has been folded into the FES, the FES has expanded considerably, with an initial estimated cost of $1.3 billion for the 2022-23 school year.

In 2019-20, FEFP funds rerouted to private schools represented 3% of total FEFP K-12 state aid ($12.5 billion). In 2022-23, this proportion increased to 10% of the $13.2 billion in FEFP state aid. This cost is in addition to tax credits provided to businesses to fund the Florida Tax Credit Scholarship voucher program, which will allow up to $1.1 billion in tax credits in state fiscal year 2023.

Impact on School District Budgeting

Florida school districts must adopt their budgets well in advance of the start of the school year. Most funding is earmarked for fixed cost expenditures, such as staff salaries and school facilities maintenance. These expenditures cannot be easily reduced during the school year or even from one school year to the next. Thus, a significant increase in the diversion of funding from district budgets to private school vouchers can have a substantial negative impact on school budget planning and lead to end-of-year deficits and sudden layoffs.

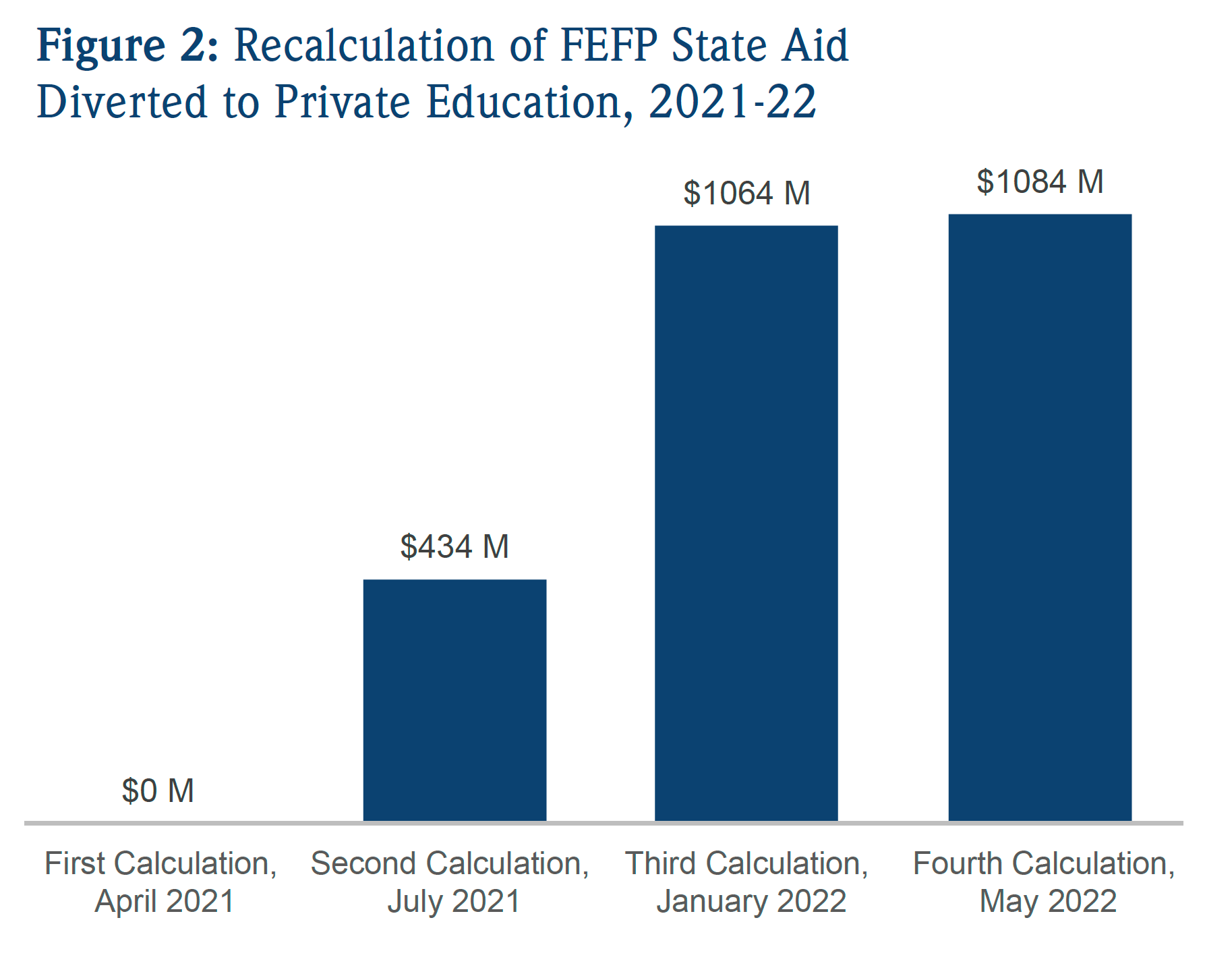

To complicate matters, Florida school districts do not know before the start of the school year just how much of their FEFP formula funding will be allocated from their budgets to private education. For example, as seen in Figure 2, in April 2021, the Florida Department of Education released FEFP calculations for the 2021-22 school year with no funds redirected to private education. By the 4th calculation in May 2022, school districts were required to reroute over $1 billion in district state aid to provide McKay and FES voucher funding to private education.

Disparate Impact on Districts

The impact of the state’s voucher programs varies depending on the district. Voucher funding is calculated on a per-pupil basis, including both state and local amounts of FEFP funding for each voucher student residing in the district. However, the entire voucher cost is diverted from the district’s state aid allocation, meaning that districts that are more heavily reliant on local funding tend to lose less district funding overall but will see proportionately larger state aid cuts. The map below highlights the proportion of each district’s FEFP budget sent to voucher schools. Data for all school districts are available in the appendix.

- In 2022-23, Gadsden County is the most highly impacted by voucher costs, losing 9% of their total FEFP budget to vouchers. Hardee County, at the other end of the spectrum, loses 1% of their budget.

- Voucher costs as a percentage of state aid range from 1% in Hardee and Calhoun County to 23% in Sarasota County (4% of overall budget).

- In 2022, Miami-Dade, the state’s largest district, enrolled 330,000 majority low-income and majority Hispanic students. An estimated $225 million public school dollars will be diverted to private education from the district in 2022-23, representing 8% of the district’s total FEFP budget and 18% of the state aid portion of the budget.

This enormous increase in the flow of public dollars to fund private education has happened so quickly that many Floridians are likely unaware of the financial impact being placed upon public school districts and the way these voucher programs are affecting the availability of their tax dollars for public education.

What’s Next

This enormous increase in the flow of public dollars to fund private education has happened so quickly that many Floridians are likely unaware of the financial impact being placed upon public school districts and the way these voucher programs are affecting the availability of their tax dollars for public education.

School districts have no control over the number of students who apply for vouchers, which makes budgeting difficult. The expansion of voucher eligibility allows higher-income families to qualify and removes the requirement for students to have previously attended public school. Once a student qualifies for a voucher, they no longer have to verify that they still meet the criteria for eligibility in future years as long as they remain in the state of Florida.

Maintaining public funds in public schools and increasing state support for public education are the keys to improving education outcomes in Florida. Redirecting state aid from an already underfunded school system only worsens the current resource struggles of Florida school districts. The following measures can help districts and students in the short-term:

- The Florida Department of Education must increase transparency in the movement of funds, including greater visibility and up-to-date figures;

- Voucher eligibility expansions need to be halted, and a periodic income recertification process should be enacted;

- Firm restrictions should be placed on the amount of funds a district may be required to redirect annually to private education to allow districts to better manage their budgets;

- State funding in the form of transitional aid should be considered to support public school districts seeing a significant increase in voucher costs.

The Constitutional Right to Public Education in Florida

The Florida Constitution declares that the education of children “is a fundamental value of the people of the State of Florida” and that “adequate provision for the education of all children residing within its borders” is “a paramount duty of the state.” Furthermore, adequate provision must be made by law for “a uniform, efficient, safe, secure, and high quality system of free public schools that allows students to obtain a high quality education.” Fla. Const., art. IX, §§ 1(a)-(b).

Florida statute sets forth the system by which public schools are funded. Pursuant to Fla. Stat. § 1011.01 the State Board of Education must present an annual budget request, clearly defining the needs of public school districts, to the Governor and Legislature. The Florida Legislature annually appropriates the funds for operation of the public schools, to be distributed through the Florida Education Finance Program. Fla. Stat. §§ 1011.60 – 1011.66. In addition, the state provides for categorical funding for public schools. Fla. Stat. §§ 1101.67-1011.803.

The Florida Supreme Court has held that the state’s use of public funds to pay for private schools fosters “plural, nonuniform systems of education in direct violation of the constitutional mandate for a uniform system of free public schools.” Bush v. Holmes, 919 So. 2d 392, 398 (Fla. 2006).

Endnotes

[1] Data were downloaded as of August 26, 2022, from the Florida Education Finance Program Calculations and the Florida Department of Education School Choice reports.

ABOUT THE AUTHORS

Mary McKillip, PhD, is a Senior Researcher at Education Law Center. She leads ELC’s research examining the fairness of state funding systems through analyses of resource equity within states. Prior to joining ELC in 2018, Dr. McKillip managed school discipline and health survey data collection and analyses at the New Jersey Department of Education and conducted research on the high school to college transition at the College Board. She has a PhD in Sociology from the University of Illinois and a MEd from Harvard University.

Norín Dollard, PhD, is Senior Policy Analyst and Director of KIDS COUNT at Florida Policy Institute. She has more than 30 years of health services research and evaluation experience in Florida and New York in the area of behavioral health needs of children and families across child-serving systems. Dr. Dollard holds a PhD in Education from the University of South Florida and an MPA from the University at Albany – State University of New York.

ACKNOWLEDGEMENTS

This report was developed in collaboration with Public Funds Public Schools, a project of ELC and the Southern Poverty Law Center. The Hatcher Group designed the report.

We extend appreciation to the many funders and allies who support ELC’s mission and work. This report is based on research funded by the W.K. Kellogg Foundation.